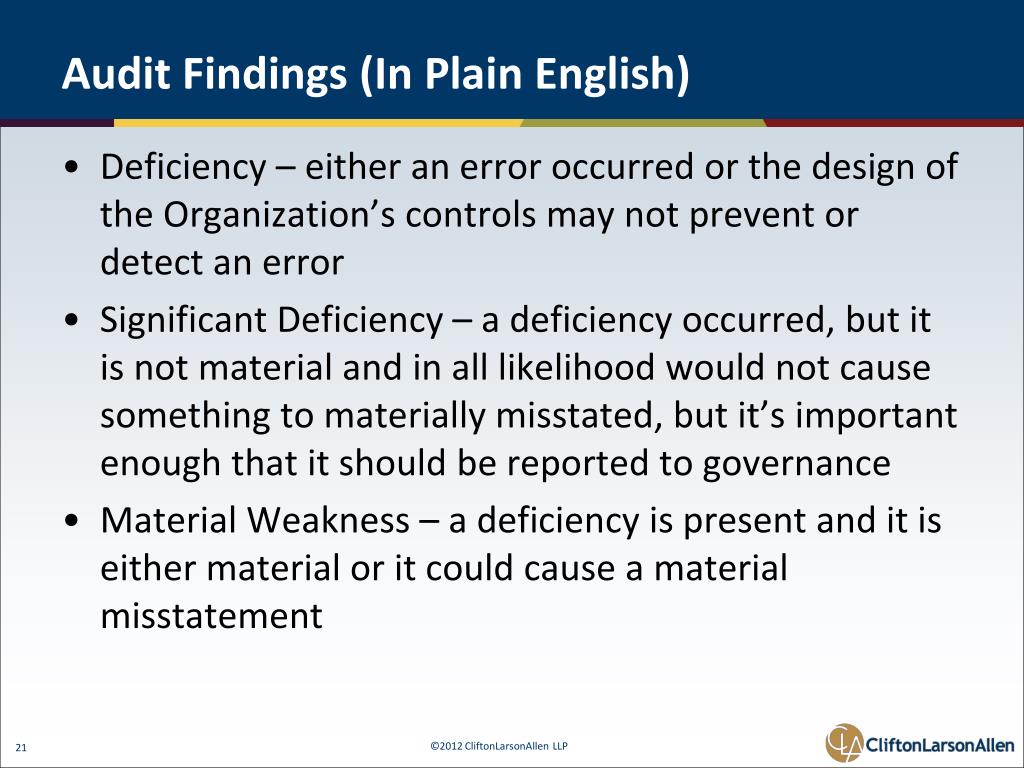

In most part, such expenditure is incurred as a result of non-compliance with legislation.Materiality is a concept or convention within auditing and accounting relating to the importance/significance of an amount, transaction, or discrepancy. To enhance accountability, auditees must identify and fully disclose any unauthorised, irregular as well as fruitless and wasteful expenditure incurred. Material instances of non-compliance are reported in the audit report.

The Public Audit Act requires us to audit compliance with legislation applicable to financial matters, financial management and other related matters each year. Auditees are subject to legislation such as the Municipal Finance Management Act and the Municipal Systems Act, of which the objectives are proper financial management and performance management, transparency, accountability, stewardship and good governance. Legislation sets out the activities that auditees are charged with in serving the citizens and stipulate any limits or restrictions on such activities, the overall objectives to be achieved, and how due process rights of individual citizens are to be protected. However, these conclusions have not yet been elevated to the level of the audit report. Since the 2009-10 financial year, we have included a separate audit conclusion, based on the results of the audit on predetermined objectives, in management reports. Since the 2005-06 financial year, we have been phasing in the auditing of predetermined objectives and explaining to leaders within all spheres of government the importance of lending credibility to published service delivery information through the auditing thereof. This means that the reported performance information must be valid, accurate and complete. The objective of our audit of predetermined objectives is to determine whether the reported performance against auditees’ predetermined objectives in the annual performance report is useful and reliable in all material respects, based on predetermined criteria. Legislation requires auditees to report against their predetermined objectives and to submit such annual performance reports for auditing. The audit of reporting on predetermined objectives The lack of sufficient evidence is not confined to specific amounts, or represents a substantial portion of the information contained in the financial statements.Īpart from auditing the financial statements, our other reporting responsibilities include auditing auditees’ reporting on their predetermined objectives and auditing auditees’ compliance with legislation. The auditee provided insufficient evidence in the form of documentation on which to base an audit opinion. The financial statements contain material misstatements that are not confined to specific amounts, or the misstatements represent a substantial portion of the financial statements. The financial statements contain material misstatements in specific amounts, or there is insufficient evidence for us to conclude that specific amounts included in the financial statements are not materially misstated. Unless we express a clean audit outcome, findings have been raised on either reporting on predetermined objectives or non-compliance with legislation, or both these aspects. The financial statements contain no material misstatements.

Material findings audit free#

The financial statements are free from material misstatements (in other words, a financially unqualified audit opinion) and there are no material findings on reporting on performance objectives or non-compliance with legislation.

We can express one of the following audit opinions: The objective of an audit of financial statements is to express an audit opinion on whether the financial statements fairly present the financial position of auditees at financial year-end and the results of their operations for that financial year. Examples include the incorrect or incomplete classification of transactions, or incorrect values placed on assets, liabilities or financial obligations and commitments. Misstatements refer to incorrect or omitted information in the financial statements. The financial statements submitted for auditing must be free from material misstatements.

0 kommentar(er)

0 kommentar(er)